Table of Contents

- What’s the Deal with Surging Bond Yields? | J.P. Morgan

- Bond Market, Gold, Yield Curve And The Changes To Come | Seeking Alpha

- Foreign outflow from bond market seen continuing in 2018, says RAM ...

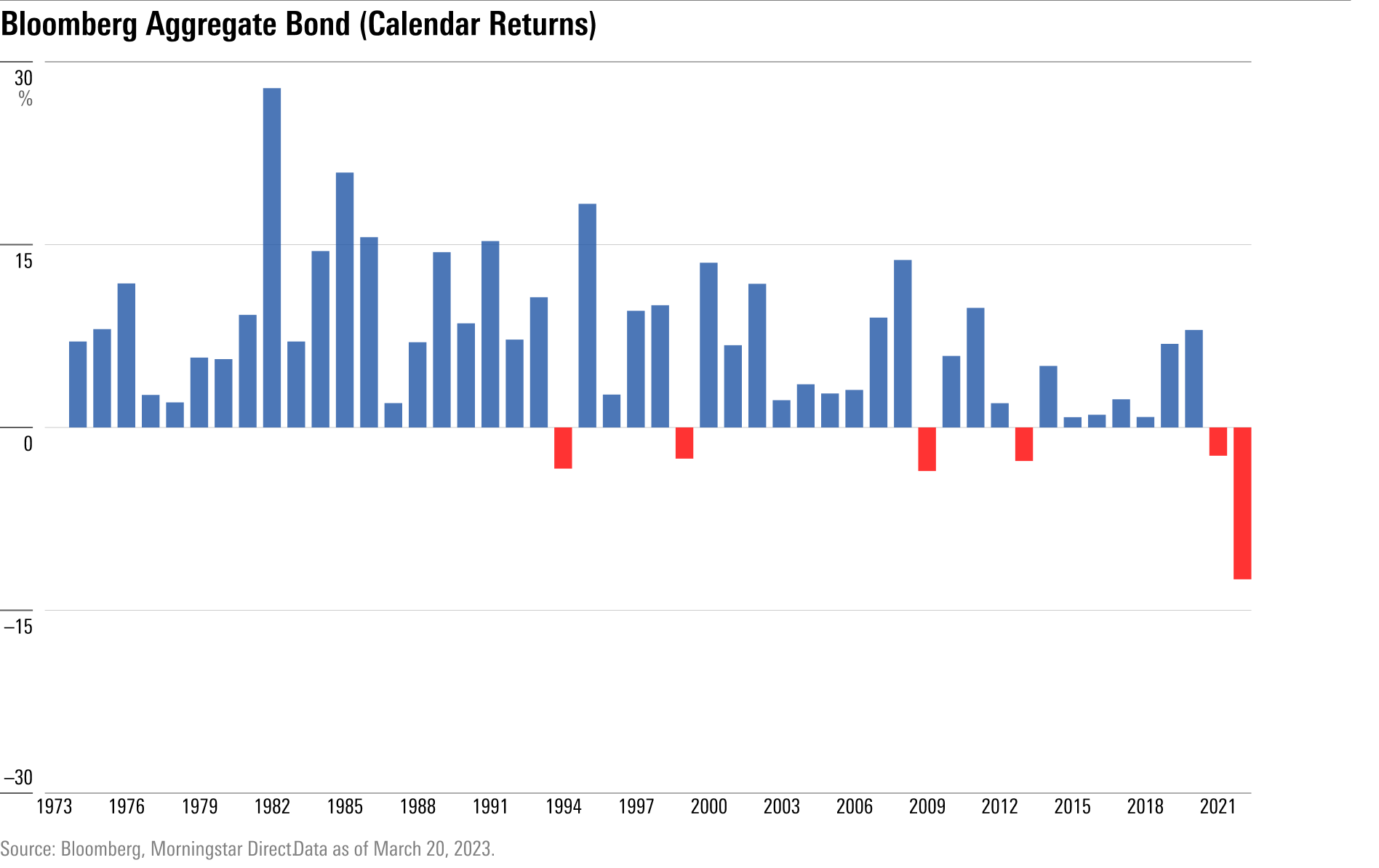

- The Return of the Bond Market | Morningstar

- How the Bond Market Works - YouTube

- How Bonds Are Priced

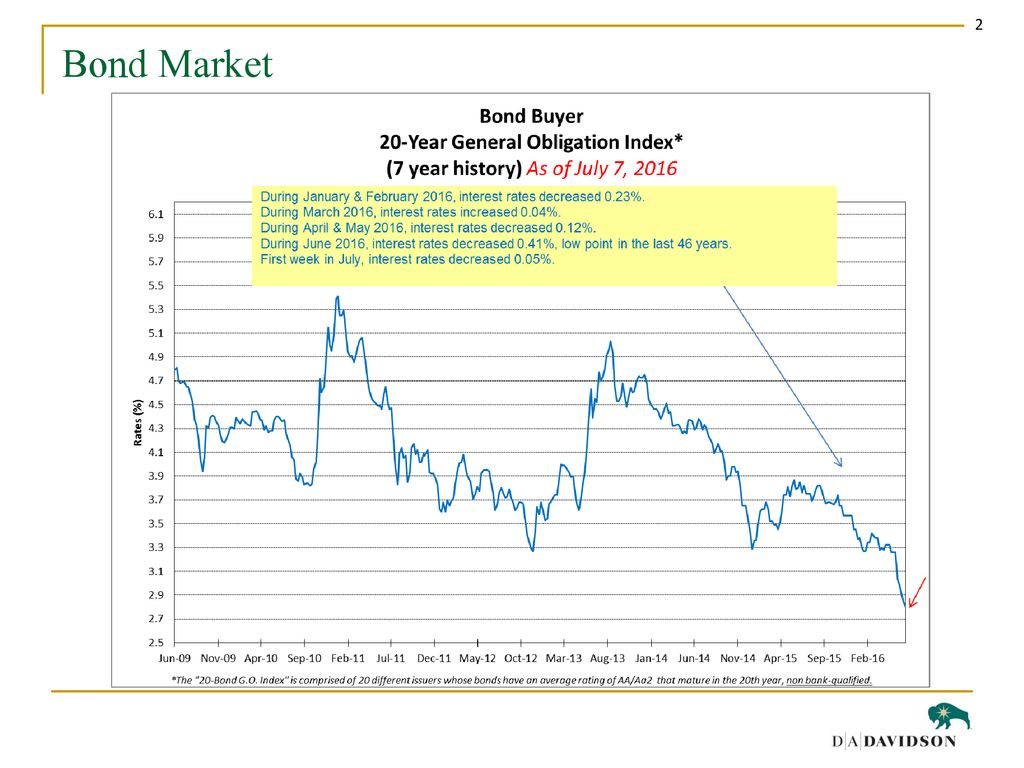

- Refunding bond discussion - ppt download

- PPT - Bond Market Indicators Smrtalgo.com PowerPoint Presentation, free ...

- Bonds - CathalAghamjot

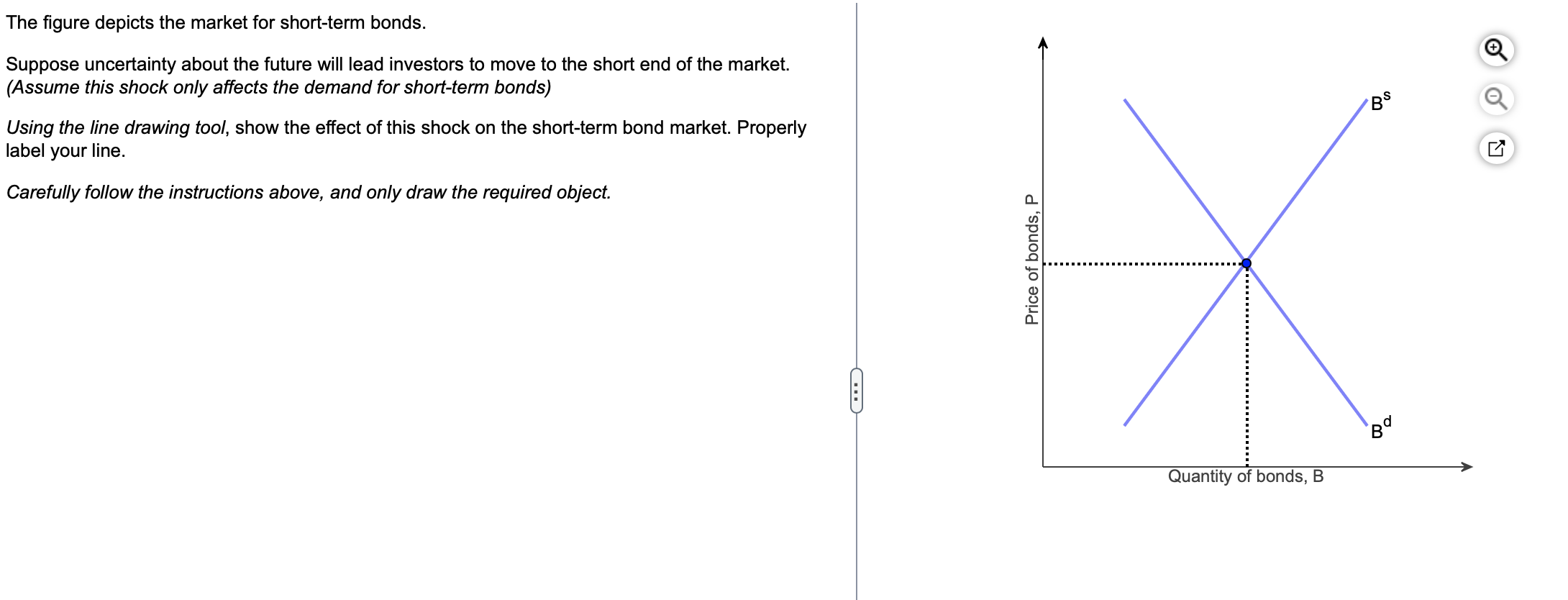

- Solved The figure depicts the market for short-term bonds. | Chegg.com

/GettyImages-81897180-b091a34e0f4e4bcd888f5023d4cc1d31.jpg)

What are Bonds?

How do Interest Rates Affect Bonds?

CNBC's Coverage of Bonds and Rates

CNBC provides comprehensive coverage of the bond market and interest rates, offering investors valuable insights and analysis. Their team of experts, including economists, analysts, and market commentators, provide real-time updates on market trends, economic indicators, and central bank decisions. By following CNBC's coverage, investors can stay informed about the latest developments in the bond market and make informed decisions about their investments.

The Impact of Central Banks on Interest Rates

Central banks, such as the Federal Reserve in the United States, play a significant role in setting interest rates. By adjusting interest rates, central banks can influence the overall direction of the economy, controlling inflation, and promoting economic growth. CNBC closely monitors central bank decisions, providing in-depth analysis of the potential impact on the bond market and interest rates.

Key Takeaways for Investors

When it comes to bonds and interest rates, there are several key takeaways for investors: Understand the relationship between interest rates and bond prices Monitor central bank decisions and their impact on interest rates Diversify your portfolio to minimize risk Stay informed about market trends and economic indicators By following these tips and staying up-to-date with CNBC's coverage of bonds and rates, investors can make informed decisions and navigate the complex world of bond investing. In conclusion, bonds and interest rates are essential components of the investment landscape. By understanding how they work and their relationship, investors can make informed decisions about their investments. CNBC's comprehensive coverage of the bond market and interest rates provides valuable insights and analysis, helping investors stay ahead of the curve. Whether you're a seasoned investor or just starting out, it's essential to stay informed about the latest developments in the bond market and interest rates.For more information on bonds and interest rates, visit CNBC and stay up-to-date with the latest news, analysis, and expert commentary.